Rapidly Approaching Production - Lindi Jumbo

Currently in final stages of construction, Walkabout’s 100%-owned Lindi Jumbo Graphite Mine is scheduled for first production in Q1 of 2024 and will supply 40,000 tonnes of premium natural flake graphite to international markets, at a time when significant shortfalls are looming.

Situated in south-eastern Tanzania, some 200km from the Port of Mtwara and 460km from Dar es Salaam Tanzania’s Capital, the Lindi Jumbo mining licence is set within the highly prospective Mozambique belt, known for its world-class, coarse flake graphite deposits.

The exceptional high-grade orebody with its highly amenable metallurgical characteristics, and exceptional distribution of large flakes within final concentrate provides significant competitive advantage in capital and operating costs and is forecasted to be the second-highest margin natural flake graphite project globally (Benchmark Mineral Intelligence, 2019).

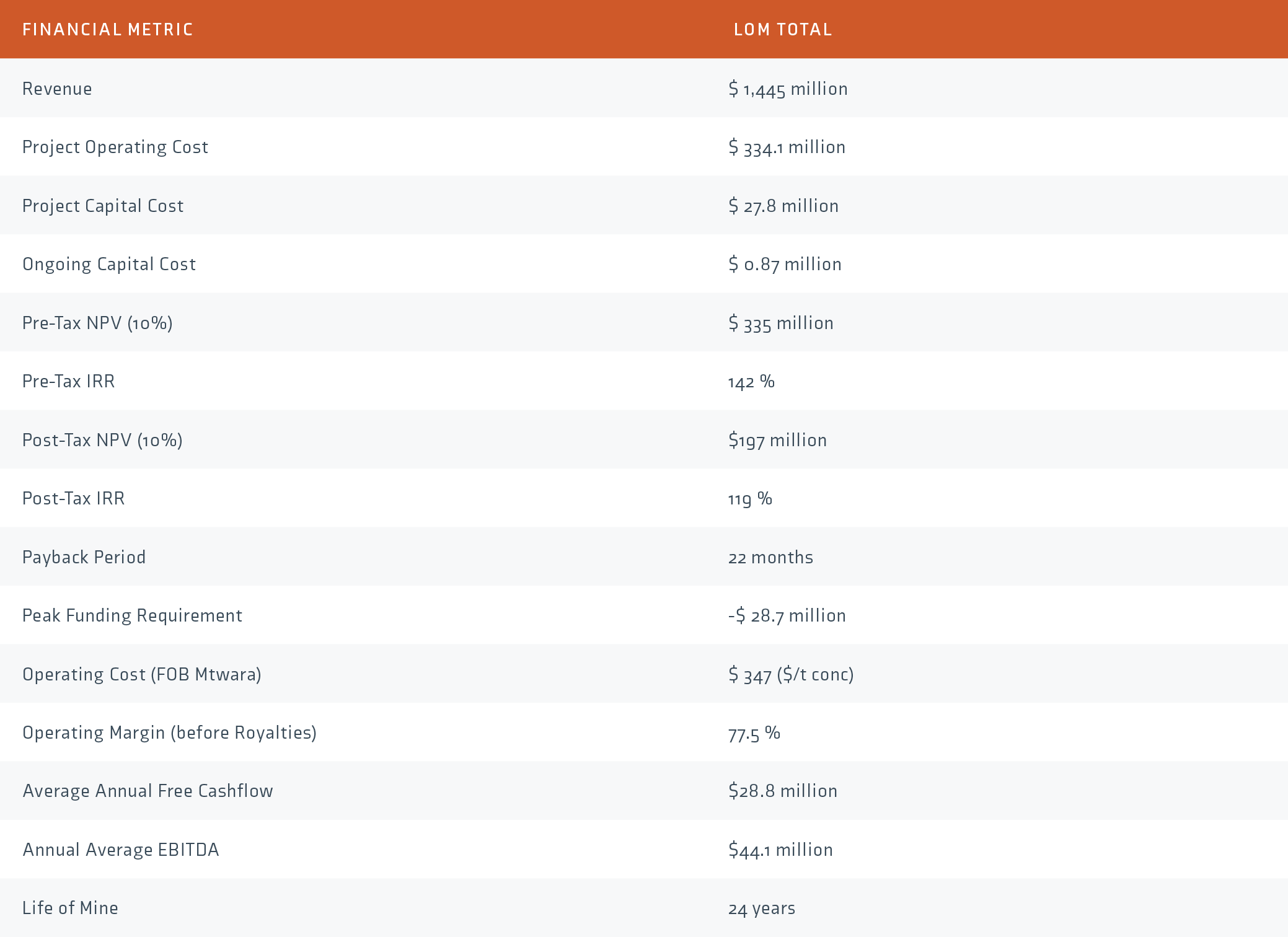

Financial Metrics

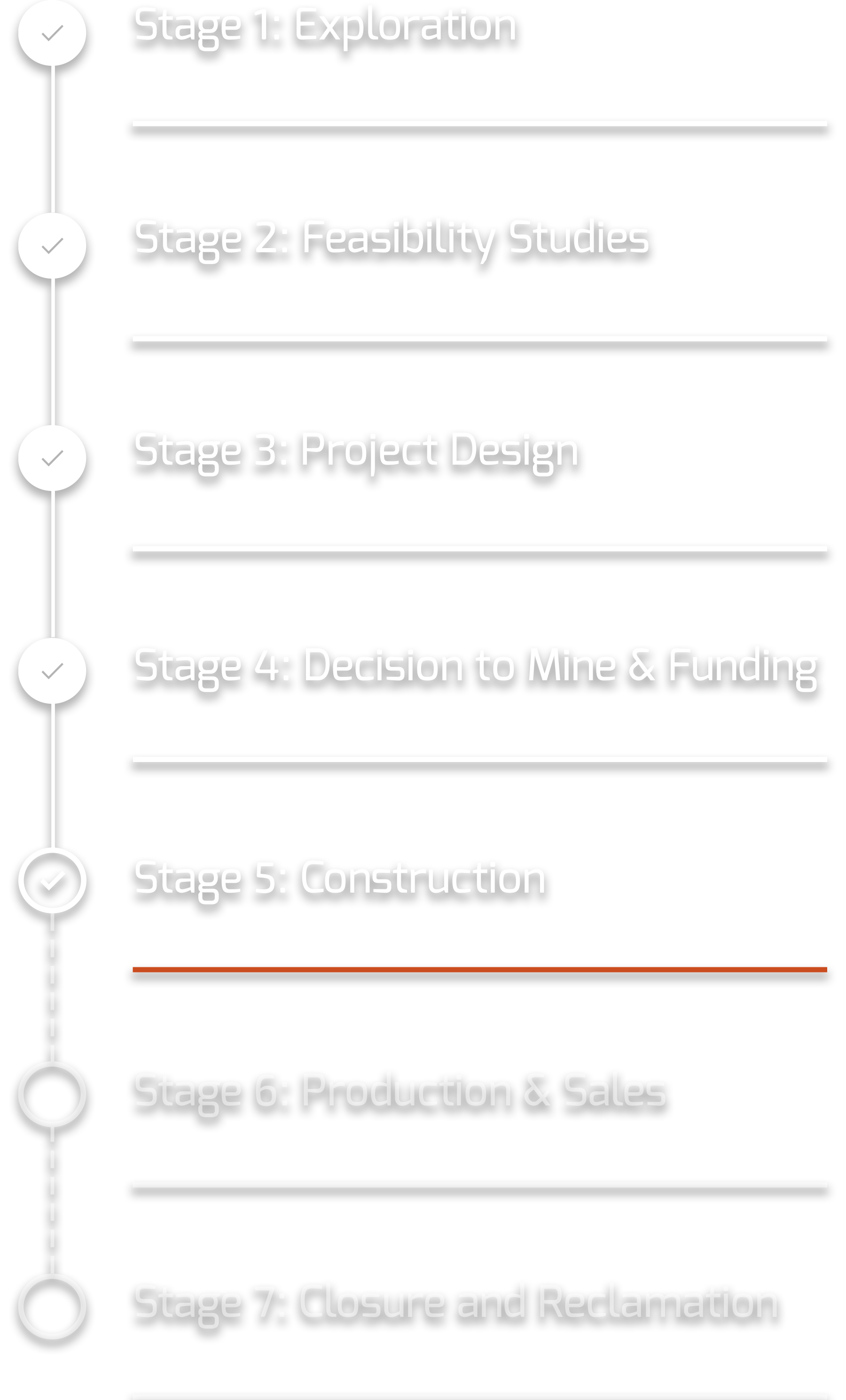

TIMELINE TO PRODUCTION

Construction

- Plant commissioning is on track for Q4, 2023

- First production is anticipated by Q1, 2024

The Road to Construction at Lindi Jumbo

At the end of Q1 2023, Walkabout Resources announced to market that it had successfully signed a term sheet with emerging markets focussed investment fund manager, Gemcorp, for up to US$25 million, to see the Lindi Jumbo mine through to production. (See ASX Announcement 29 March 2023).

The loan agreement was formally executed in early July, with an allocation of US$20 million (Tranche A) and an optional US$5 million (Tranche B) outlined, along with terms. This formalisation meant that funding could now be accessed and drawn upon. (See ASX Announcement 4 July 2023).

The first issuance of funds was allocated to repay preceding interim funding measures put in place by the Company. Up until first drawdown, interim funding measures had ensured continuity of construction activities and minimised delays to the development schedule prior to the Company securing a formal funding agreement. These repayments were concluded in Q3 of 2023. (See ASX Announcement 28 August 2023).

Construction of the Lindi Jumbo graphite mine began in September 2021 and production is expected in early 2024.

As at September 2023

- All essential civils at the processing plant are now 100% complete.

- Current focus on completing mechanical installation within the Concentrator Building (milling and flotation).

- Works for completion of the steel framework of the Concentrator Building are well advanced.

- Construction of the steel framework for the Drying and Screening Building has started.

- TSF ~92% complete. Bulk earthworks complete.

Other Project Highlights

Study Highlights

DFS: The company took the Lindi Jumbo project from discovery in October 2015 to the completion of a highly robust Definitive Feasibility Study within 16 months. Following the DFS being finalised in early-mid 2017, Walkabout Resources were granted a mining lease over the deposit.

The following are highlights of the findings of the feasibility study:

- Lowest operating costs in Tanzania of US$347/t in concentrate FOB at the port of Mtwara.

- Lowest upfront Capex in Tanzania of US$27.8 million.

- Highest Ore Reserve grade in Tanzania at 17.9% TGC

- Ore reserve based only on 37% of the Measured and Indicated portion of the Mineral Resource

- Very short development timeframe of seven months from financing.

Read the full DFS announcement here

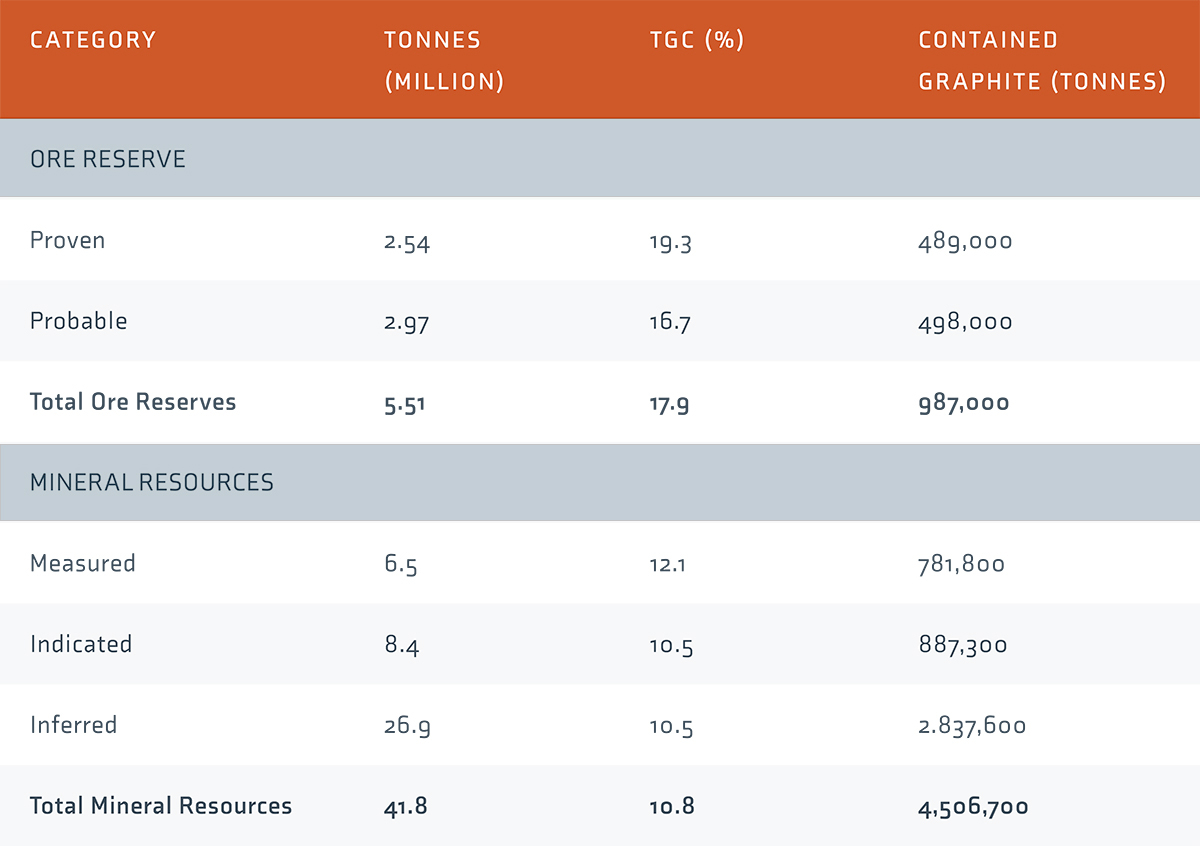

Mineral Resources

The JORC compliant Lindi Jumbo Deposit of 41.8 million tonnes @ 10.8% TGC remains open along strike and at depth and the Mining Licence is surrounded by approximately 160 square kilometres of highly prospective ground for high-grade, large flake graphite within three Prospecting Licences under the control of Walkabout Resources.

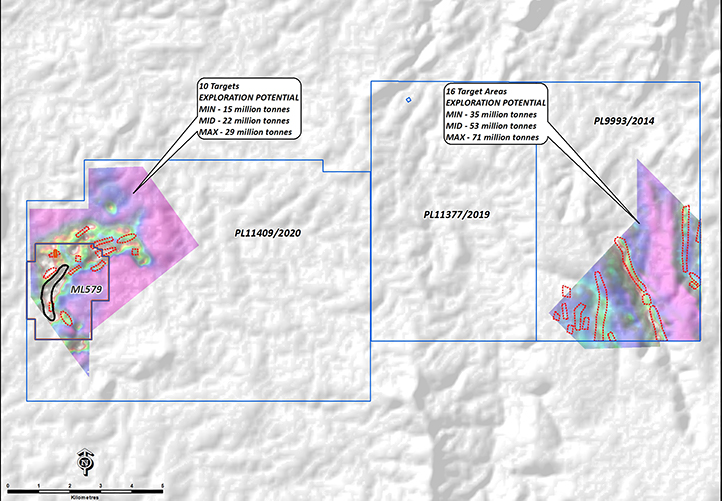

Exploration Target

In addition to the JORC compliant Mineral Resource more than 17 line-kilometres of conductive zones have been modelled on two areas covered by VTEM surveys on the Mining Licence and surrounding Prospecting Licences in close proximity to the Lindi Jumbo Graphite Mine. An Exploration Target for the two VTEM areas only has been estimated at 50 to 100 million tonnes of graphite bearing material (grade unknown).

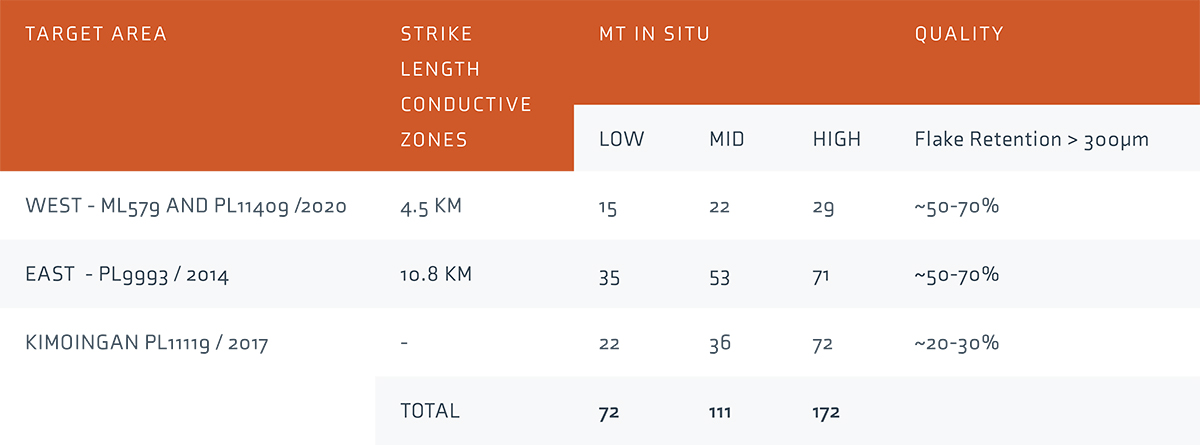

The table below contains the global or country wide Exploration Target within tenure held by the Company.

See more information in the ASX Announcement.

1Quality is based on the similar reported graphite deposits in the immediate vicinity of the exploration target areas. The Exploration Target is based on geological and structural mapping, rock chip sampling, geophysical survey data, 3D modelling of conceptual mineralisation shells, historical reports and publicly available reports of Mineral Resources in proximity to the Exploration Targets. Target testing will occur through further mapping and sampling, possible geophysical surveys, and if warranted drill testing. The timing of these programs are dependent on the availability of funds, commodity market conditions and current travel restrictions.

Exploration Targets over two VTEM areas on ML579/2018, PL13376/2018 and PL9993/2014

The potential quantity outside of the Gilbert Arc Mineral Resource Area is conceptual in nature as there has been insufficient exploration to define a Mineral Resource and it is uncertain if further exploration will result in the determination of a Mineral Resource over any of the additional target areas.

It should not be expected that the quality of the Exploration Targets is equivalent to that of Mineral Resources. Exploration Targets could be tested with future exploration activities in alignment with company’s exploration and business strategy.

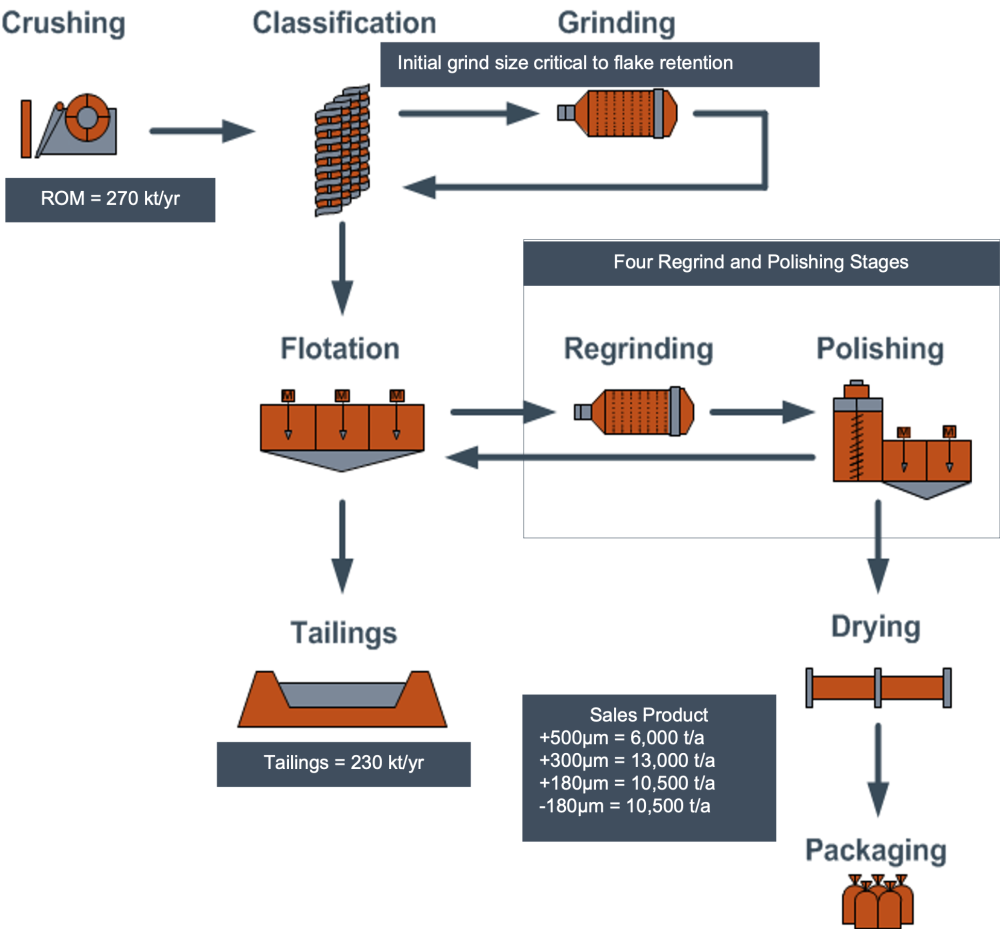

Processing Plant

The Lindi Jumbo processing plant has been designed unlike many comparable peers. In contrast to other producers, who tend to focus on the volume of graphite fines, Lindi Jumbo’s plant is optimised for flake size retention – meaning care is taken not to ‘damage or break’ large flakes, helping Walkabout Resources to increase its product grade above 95% TGC whilst preserving and maintaining exceptional large flake size distribution.

The Flow Sheet has been tested in Australia and again in China independently. Due to the nature of the graphite ore, the process is a simple means of liberating and upgrading graphitic flakes in concentration. Regular graphite processing China can require upwards of twelve regrind stages, a significant increase when compared to Lindi Jumbo’s 4 regrind and polish stages.

To support the processing plant, Walkabout Resources is constructing a high grade Run-of-Mine (ROM) feed to assist in overall efficiency and upgrades.